About your client statement quarterly

Cover Page

-

Statement Dates

The current values reported by your statement are at the final date of the three month period.

-

At Your Service

If you have any questions or concerns, here is the name and contact information of your personal IG Wealth Management Consultant.

-

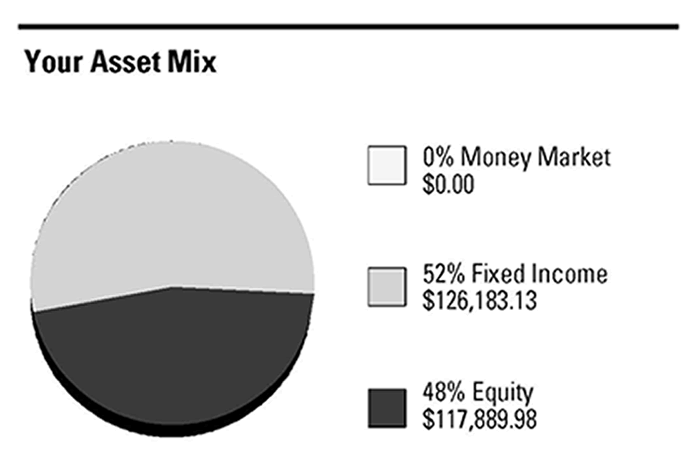

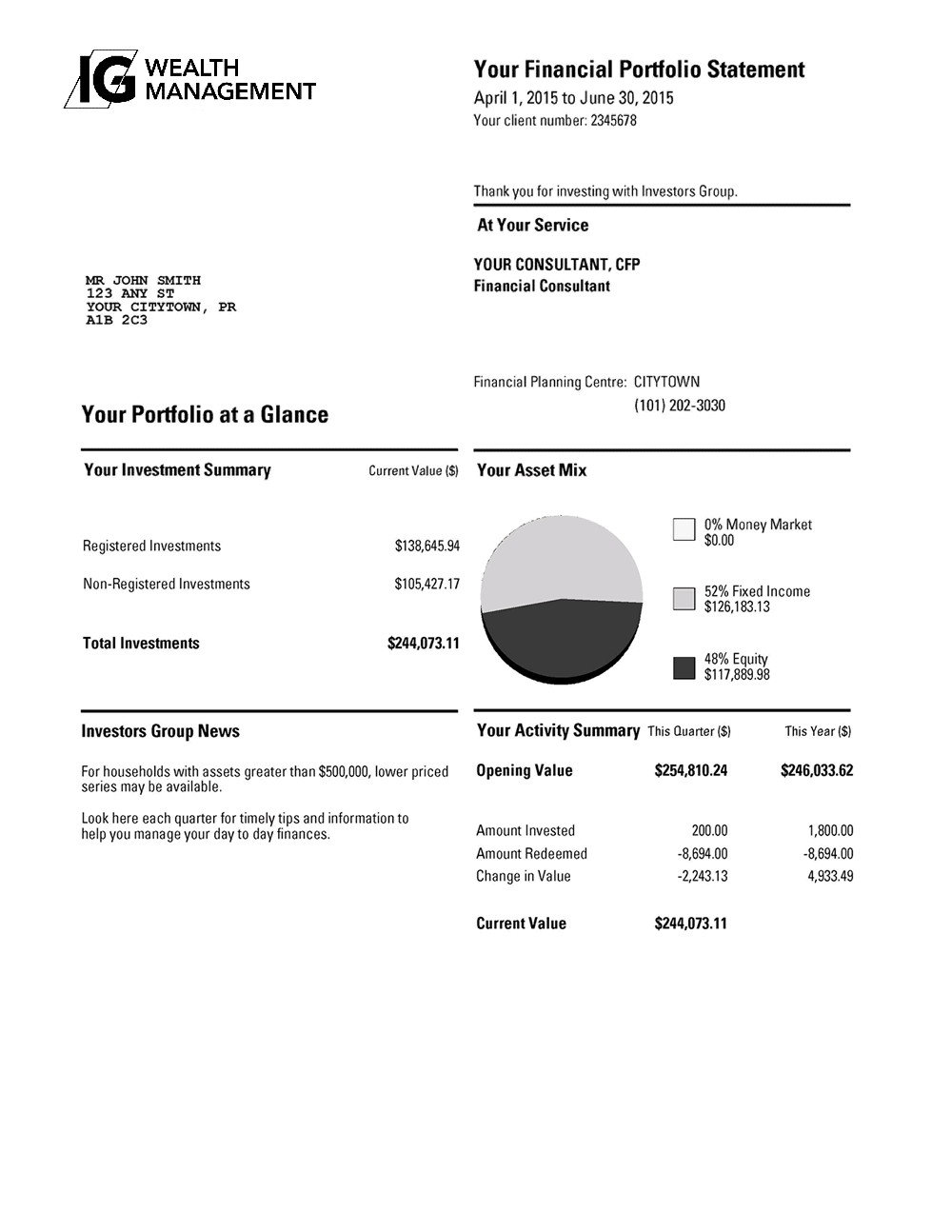

Your Asset Mix

shows how your portfolio is allocated among three asset classes: Money Market, Fixed Income and Equity. Balanced funds and asset allocation funds will be split between the fixed income and equity categories. The asset mix for these funds may change each quarter as a result of fund activity.

-

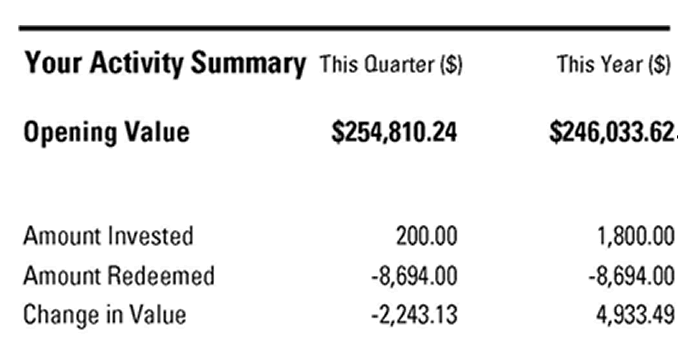

Your Activity Summary

shows the total amounts that have been invested or redeemed from your portfolio for the quarter and for the year.

Change in Value shows the impact of capital markets on your investments.

-

Current Value

is the market value of your portfolio at the close of the reporting period.

-

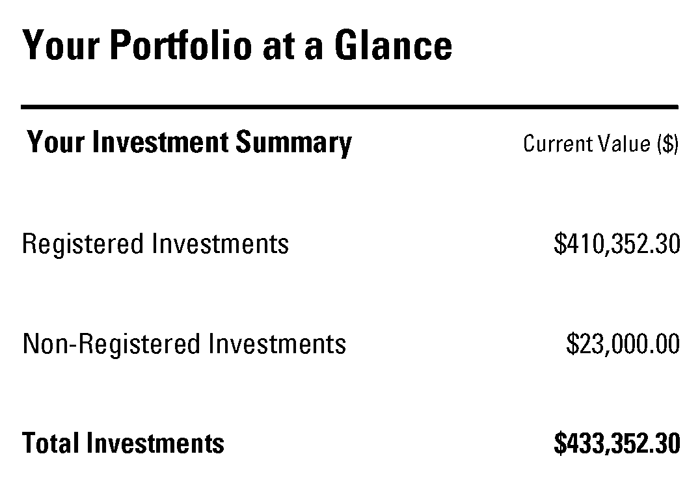

Your Portfolio at a Glance

summarizes the value of the registered and non-registered investments reported in this statement at the end of the reporting period.

-

IG Wealth Management News

This space is used to provide you with timely tips and information to help you manage your day to day finances.

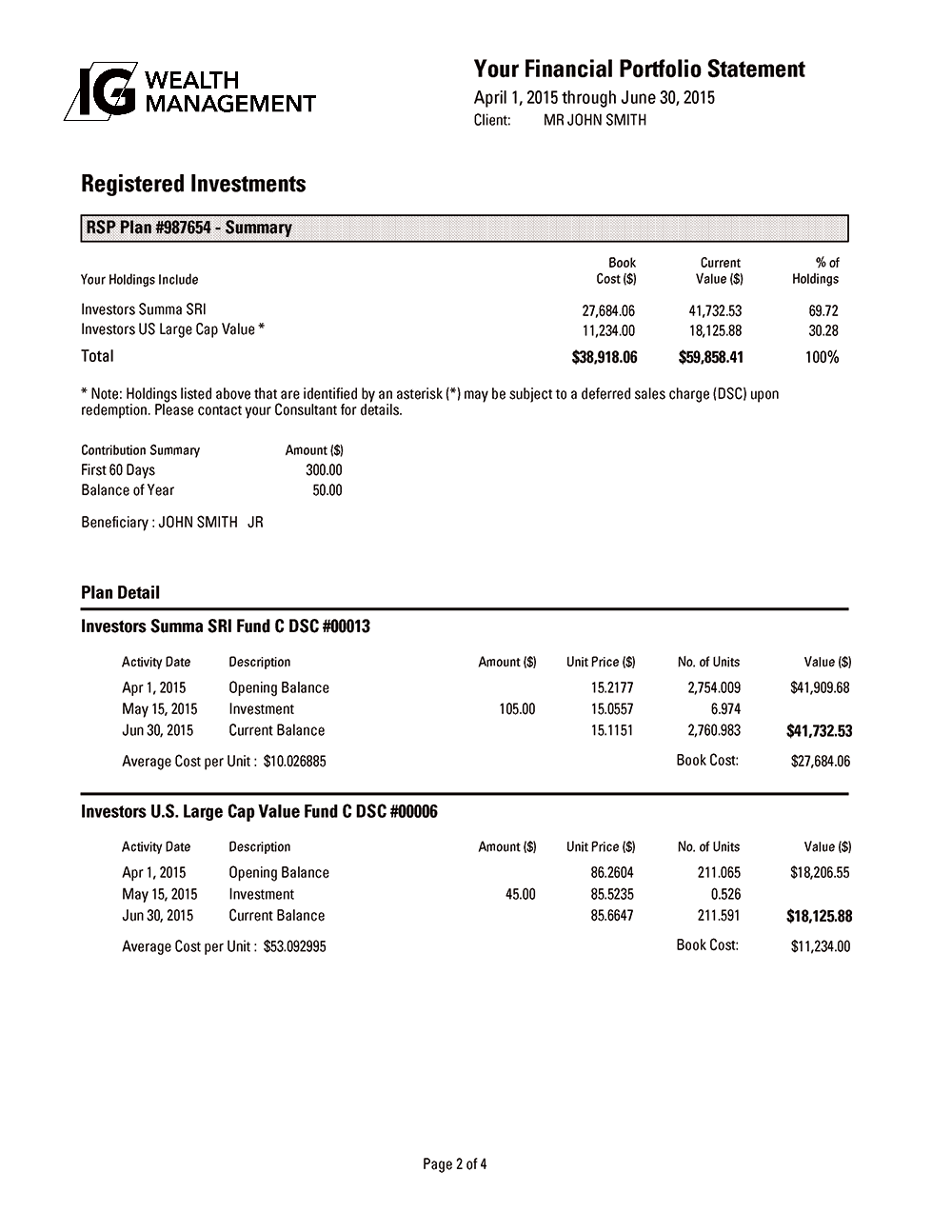

Registered Investments

Each registered investment plan (such as RSPs, TFSAs, RRIFs, LIFs, LRIFs, or RESPs) in your portfolio is also reported separately.

-

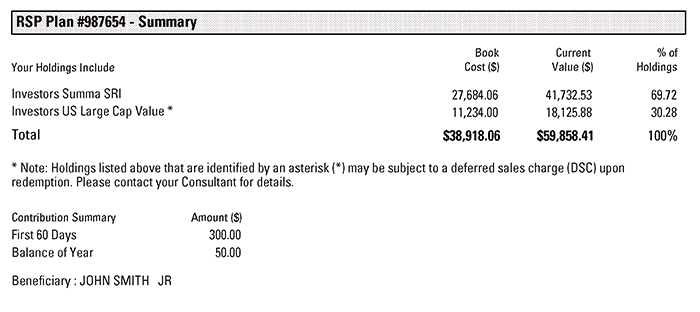

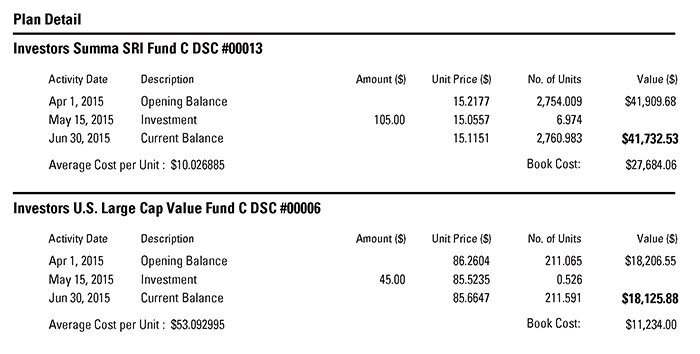

Plan Summary

provides a summary of the investments held within the Plan type, their weightings, book cost and current value.

Book Cost means the total amount paid to purchase an investment, including any transaction charges related to the purchase, adjusted for reinvested distributions, returns of capital and corporate reorganizations.

Current Value is the market value of the investments in this plan at the close of the reporting period.

% of Holdings is the percentage that each individual holding represents as part of your plan.

-

A list of your holdings

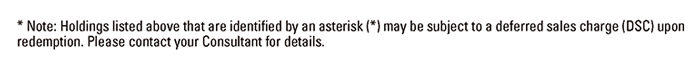

If your holdings include investments that may be subject to a deferred sales charge (DSC) upon redemption, they will be marked with an asterisk in the Summary.

A deferred sales charge (DSC) is also known as a back-end load charge. Redemptions from this type of account are subject to a charge if the redemption occurs before a prescribed time period (usually 7 years). The amount of the charge is a percent of the fund's value that decreases each year.

-

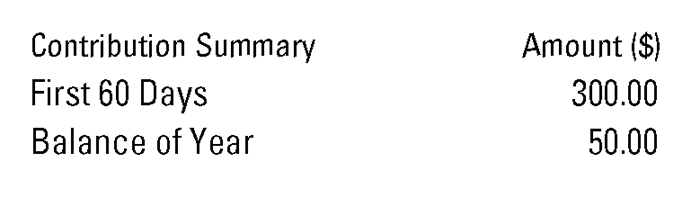

Summary Information

You can see at a glance plan contributions (RSP, TFSA, RESP), withdrawals (TFSA), payments (RIF, LRIF) throughout the year.

-

Beneficiary Information

Names of beneficiaries that you have identified. Be sure to review and update as required.

-

Plan Detail

Transaction details for each individual holding during the three-month period are reported.

-

Average Cost per Unit

is reported for mutual fund holdings.

-

Book Cost

means the total amount paid to purchase an investment, including any transaction charges related to the purchase, adjusted for reinvested distributions, returns of capital and corporate reorganizations.

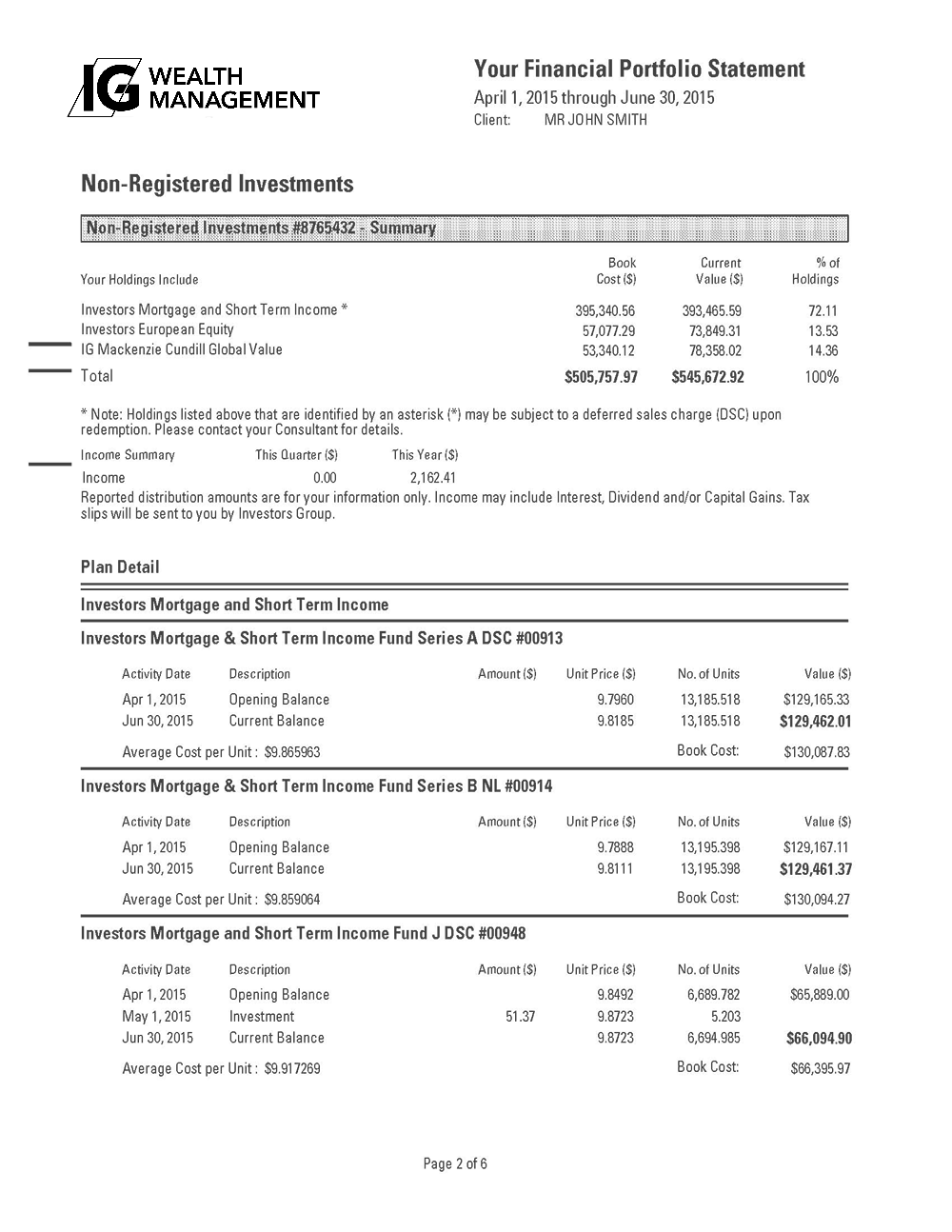

Non-Registered Investments

-

Plan Summary

provides a summary of the investments held within the Plan type, their weightings, book cost and current value.

Book Cost means the total amount paid to purchase an investment, including any transaction charges related to the purchase, adjusted for reinvested distributions, returns of capital and corporate reorganizations.

Current Value is the market value of the investments in this plan at the close of the reporting period.

% of Holdings is the percentage that each individual holding represents as part of your plan.

-

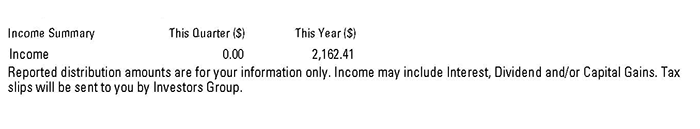

Summary Information

For Non-Registered Investments, your statement will show total income earned for the quarter and the year.

-

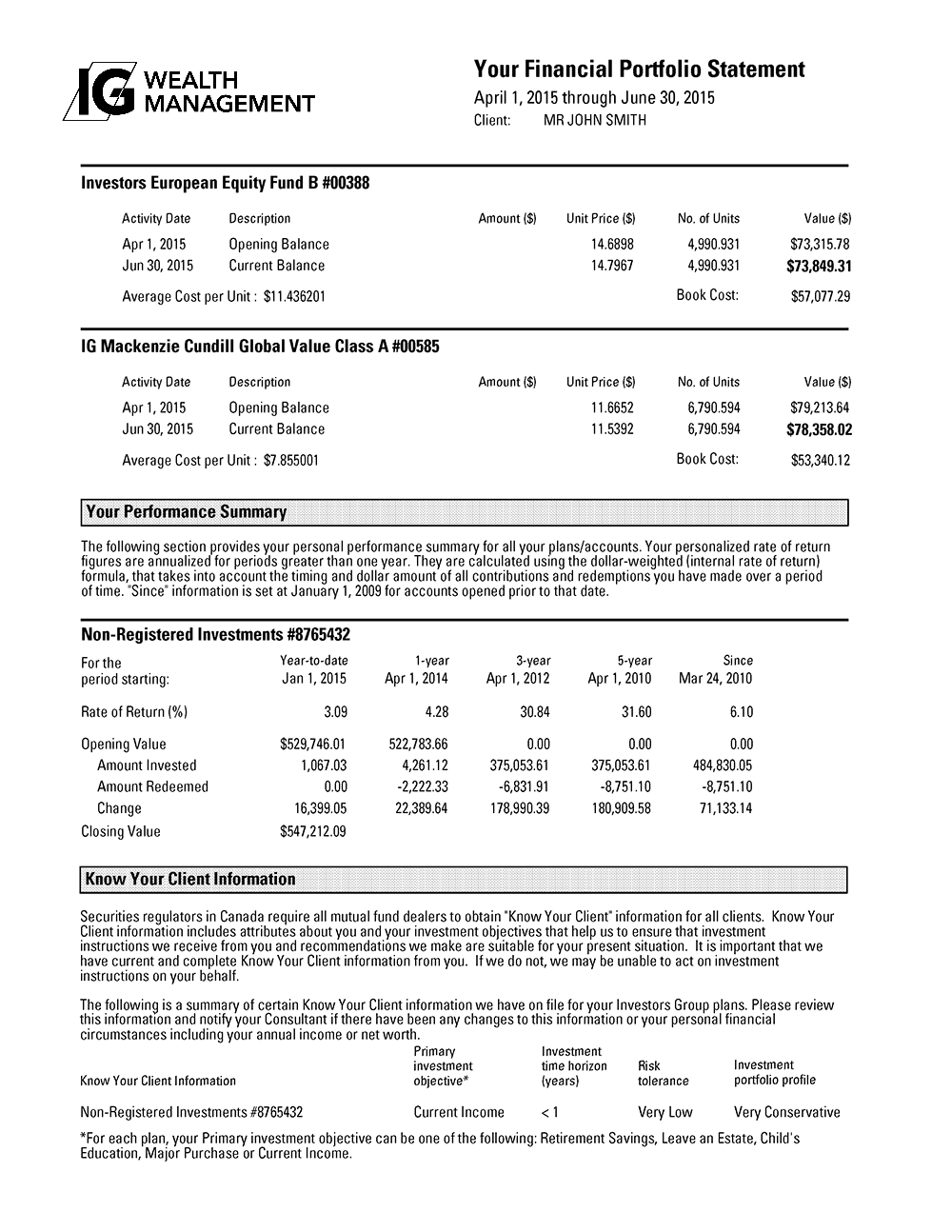

Plan Detail

Transaction details for each individual holding during the three-month period are reported.

-

Average Cost per Unit

is reported for mutual fund holdings.

-

Book Cost

means the total amount paid to purchase an investment, including any transaction charges related to the purchase, adjusted for reinvested distributions, returns of capital and corporate reorganizations.

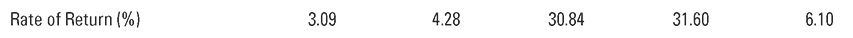

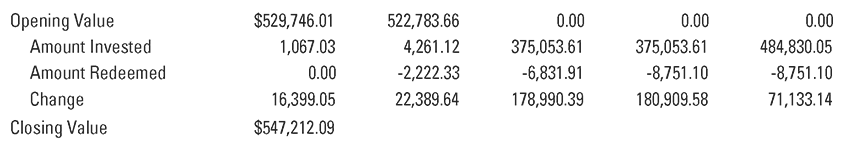

Your Performance Summary

-

Period Dates

Your rate of return will be calculated for the year-to-date, as well as the last 1, 3 and 5 years, if you were invested at the starting date for each period.

-

Rate of Return

What you need to know:

- Uses a dollar-weighted formula, standard for the Canadian investment industry.

- Takes into consideration any amounts that are withdrawn or contributed to your plans/accounts, and when they occur.

- It may be different than the fund or investment's rate of return.

- A rate of return will not be calculated for plans/accounts which consist entirely of interest-bearing GICs.

- There are rare occasions where we are unable to calculate the rate of return. Should this occur, please contact your IG Wealth Management Consultant for assistance.

-

Statement Since

For all accounts open prior to January 1, 2009, the rate of return will be calculated starting at January 1, 2009, onward. The rate of return on accounts opened after January 1, 2009 will be calculated starting from their inception date.

-

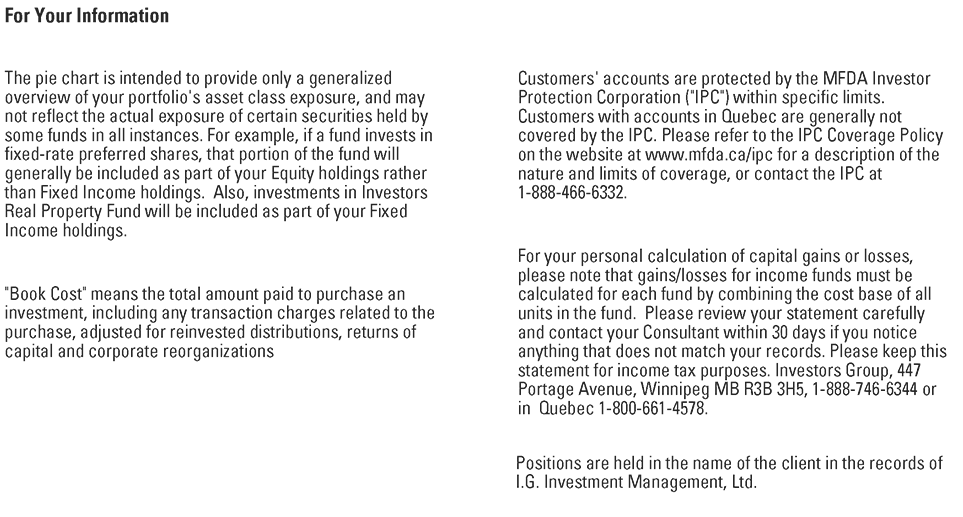

Amount Invested/Redeemed

Amount Invested may include new contributions, transfers in and grants (RESPs).

Amount Redeemed may include withdrawals, and transfers out.

-

For Your Information

At the close of your statement is timely and useful information for you to know as an IG Wealth Management client.

YOUR YEAR-END STATEMENT:

The final statement for each calendar year contains additional information including:

- A summary of capital gains or losses (if applicable).

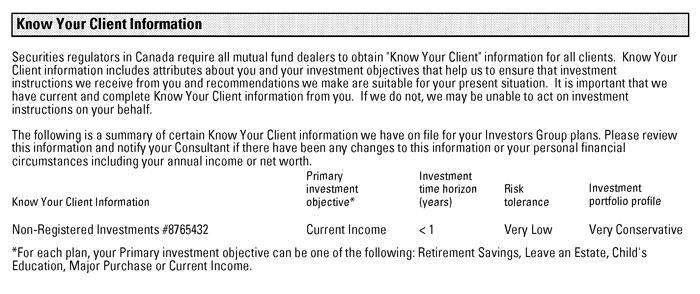

- "Know Your Client" information we have on record that summarizes the type of investor you are. For example, your time horizon, risk tolerance and level of knowledge about investing. Please advise your Advisor if this information is missing or appears incorrect.

- A summary of advisory fees for clients who hold series U funds.

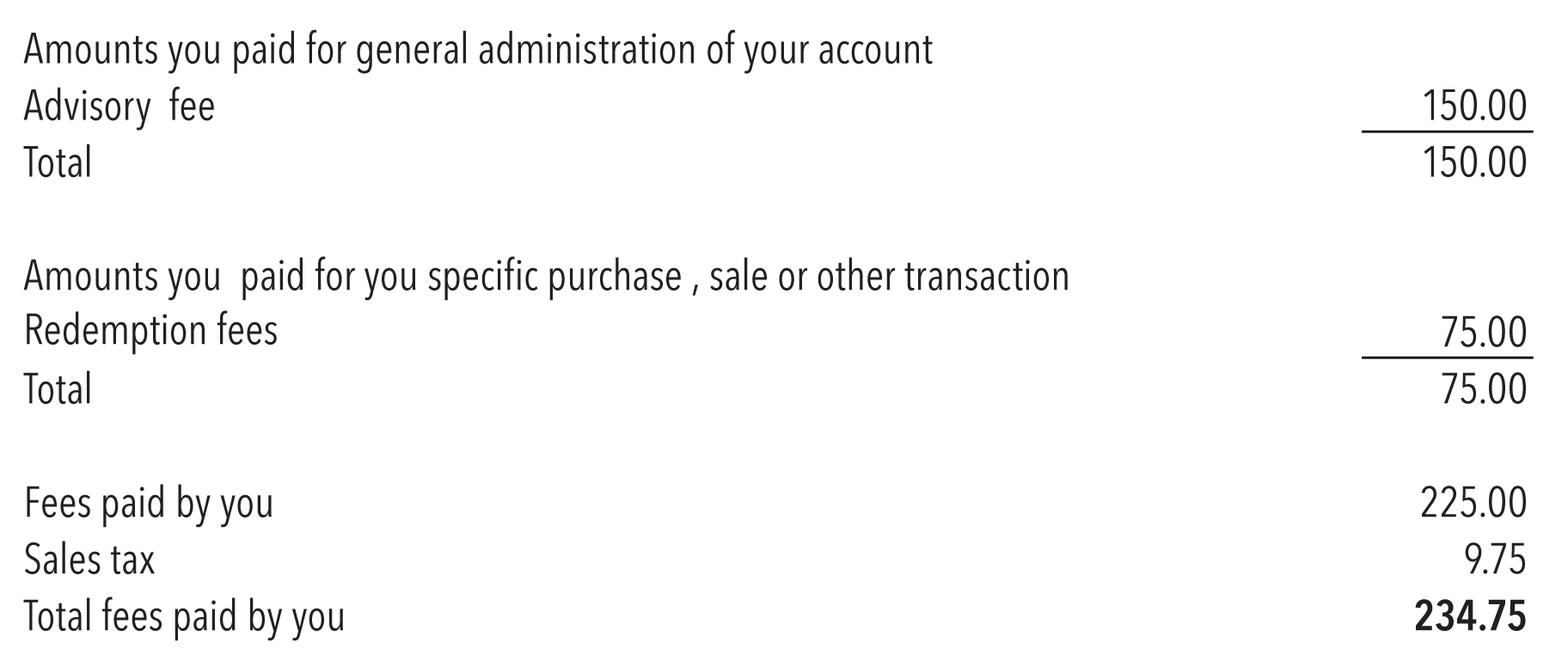

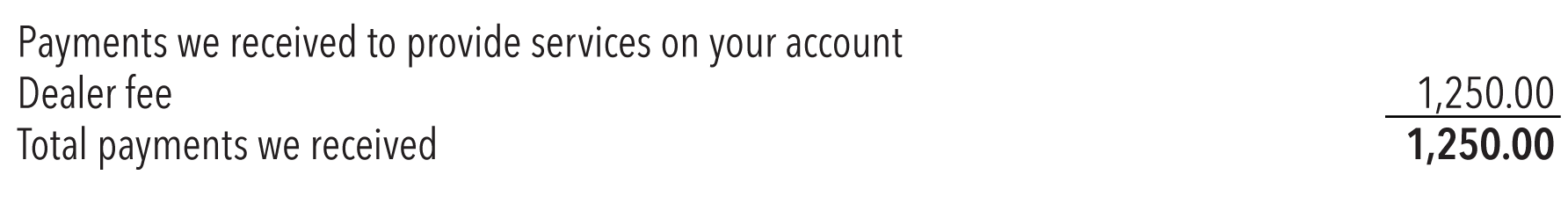

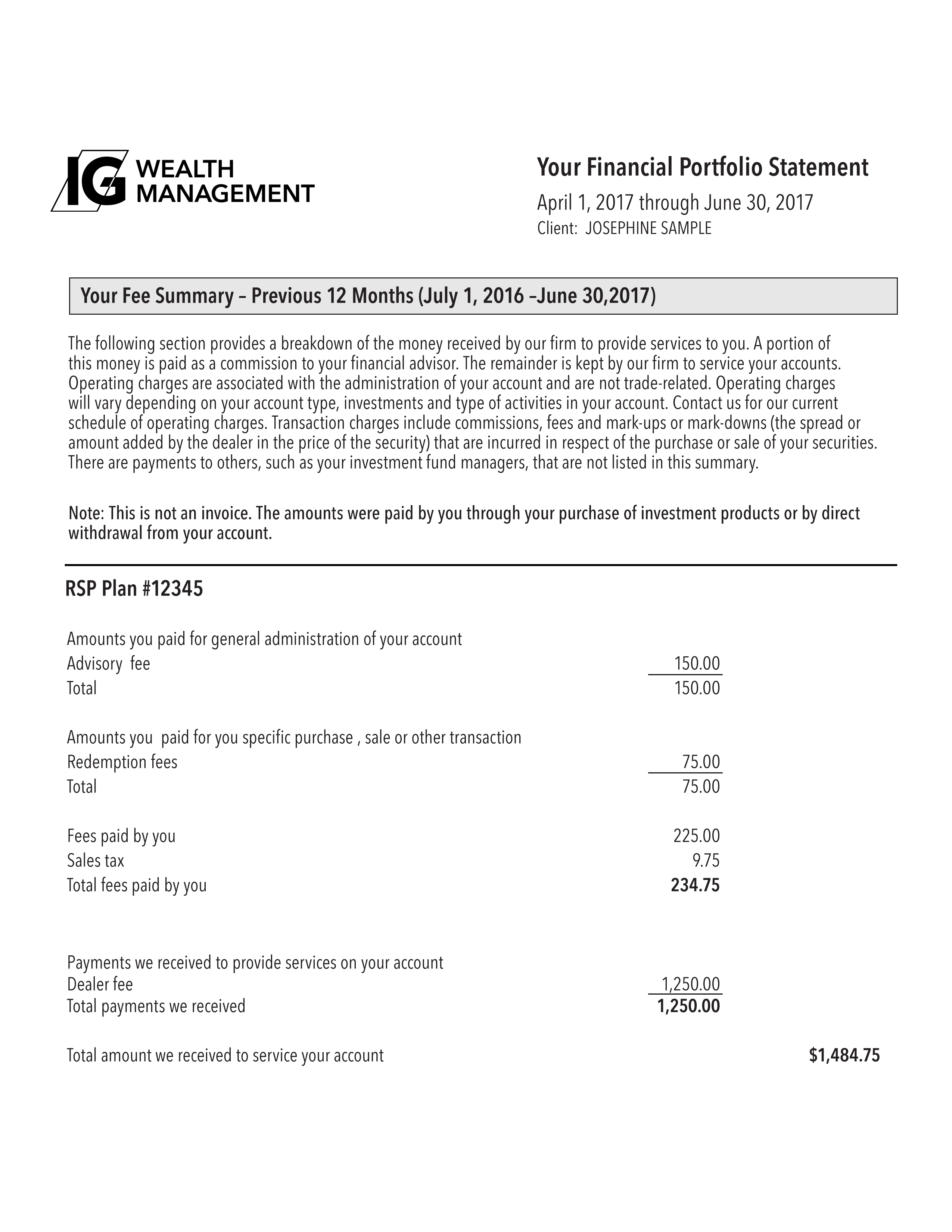

Fee Summary

Your Fee Summary provides a breakdown of the money received by IG Wealth Management to provide services to you over a 12 month period. It is included with the statement issued to you for the period ending on June 30.

There are other fees and charges which may apply to your account that are not shown on this report. They include (but are not limited to):

- Fees associated with buying or selling Guaranteed Investment Certificates (GICs) or Term Certain Annuities (TCAs).

- Fees which may be paid by funds that you are invested in.

- Certain other fees that are reported and mailed separately, (i.e. short-term transfer fees, short-term trading fees, and liquidity fees.)

See "About Fees" for more detailed information on the fees which may be applicable to your account.

-

Time Period

The Fee Summary is for the 12 months ending on June 30.

-

Direct Fees

Administration fees and transaction fees are paid directly by you. Administration fees are for general administration of your account. Transaction fees are charged for specific transactions that you initiate.

-

Taxes

Taxes may apply to some direct fees and will be added to the total amount of fees paid.

-

Indirect Fees

These are payments IG Wealth Management receives from the funds you own.

-

Dealer fee

If you own IG Wealth Management mutual funds, a dealer fee is paid by those funds to IG Wealth Management for services and advice we provide to you.

-

Total Fees

Represents the total amount of direct and indirect fees that are paid to IG Wealth Management for servicing your account in the past 12 months.

Know Your Client

-

Know Your Client

The final statement for each calendar year contains "Know Your Client" information we have on record that summarizes the type of investor you are. For example, your time horizon, risk tolerance and level of knowledge about investing. Please advise your Consultant if this information is missing or appears incorrect.

Recent Statement Enclosure

- IGFS Nominee – Information Update - May 2024

- IGFS – Information Update - May 2024

- IGSI – Information Update - May 2024

- IGFS Nominee – Information Update - May 2023

- IGFS – Information Update - May 2023

- IGSI – Information Update - May 2023

- IGFS Nominee – Information Update - May 2022

- IGFS – Information Update - May 2022

- IGSI – Information Update - May 2022

- IGFS Nominee – Information Update - May 2021

- IGFS – Information Update - May 2021

- IGFS Nominee – Information Update - June 2020

- IGSI – Information Update - June 2020

- IGFS client statement disclosure - June 2020

- Meeting your needs in changing times – April 2020

- Signing up for Online Access is fast and easy - September 2019

- Important Update – June 2019

- Fund name changes – October 2018

- Notice to Unitholders – October 2018

- Investors Group is now IG Wealth Management – September 2018